About Us

Navigating the Market, Mastering Success.

Layup Trades is the perfect place to subscribe for those traders who don't have the time to follow the market but have the desire to invest. Our traders analyze and advise on how the market is trending and provide easy to read market information and trade ideas. The Layup Trade community is kept informed through several communication platforms including MoonRoom chat and a private Twitter channel. A list of all provided services is further below.

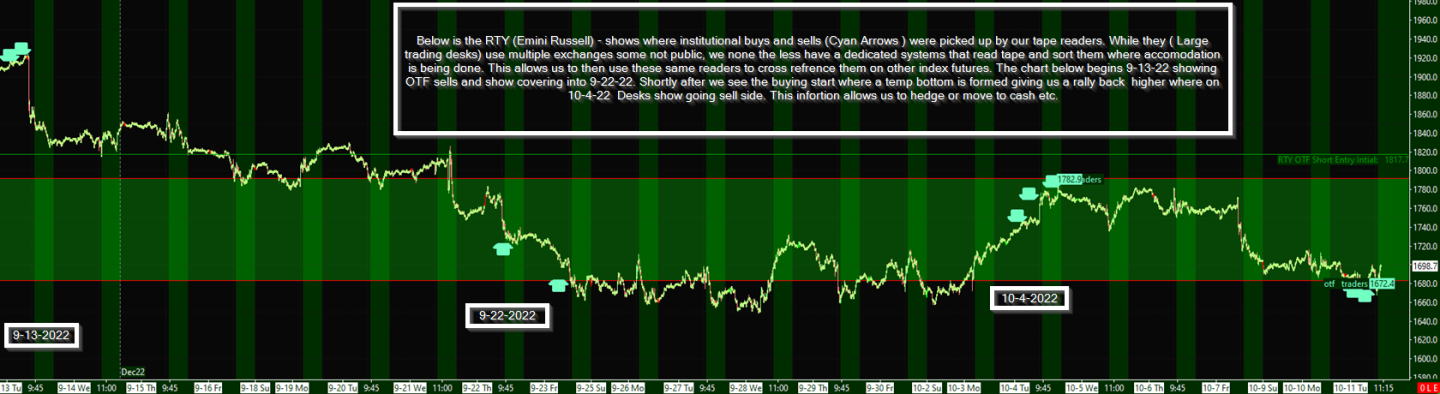

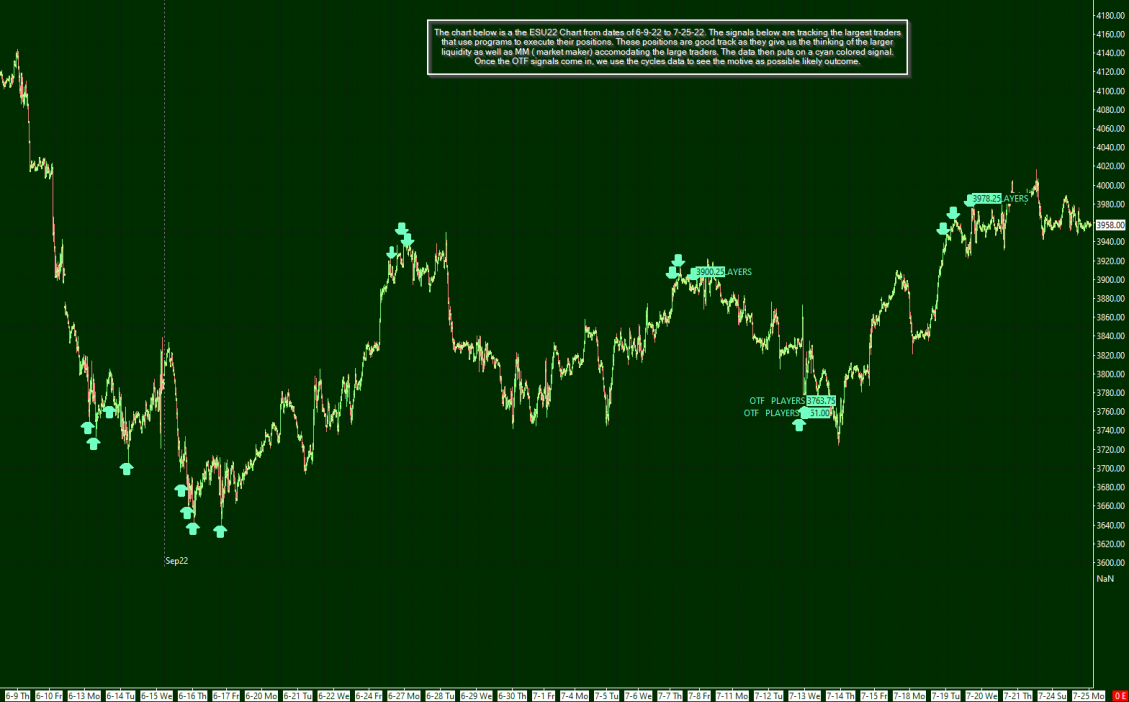

Layup Trades predominately trades common stock and options contracts when positioning into stock trades but also boasts a market futures trading room where custom created flows are shared on Sierra charts and discussed live! (Examples below)

pricing plans

Subscription Include

Access to the Layup Trades website which includes:

- Live streaming flow systems for the SPX, Nasdaq, and Top-weight stocks.

- Updated charts with customized scripts and order flow.

- Real-time support and resistance tracking for the markets and weighted stocks.

- Portfolio tracking for Oblique’s flow system, as well as Josh’s service portfolio.

- Josh’s Morning Journal

- Oblique’s Daily plan for ES futures with ‘O levels’.

- Weekly writeups sent out over the weekend.

- Monthly list of potential trade setups.

- Access to the MoonRoom chat which also offers all of the Layup Trade streams, as well as market discussion intraday. Short-term trades are also taken in the room.

- Private Twitter access.

- Monthly/Daily cycle tracking

$99 / month

$1,000 / year

Our team

Meet our analysts

Josh Vala

Josh has been trading options since 2012. He predominately uses Fibonacci retracement and volume profile as his technical analysis tools to best determine the proper risk and reward for entry and exits.

Ash (Aka Oblique)

Ash started his long journey from Options then Equities day trading before finally focusing in futures trading. Focusing on the Emini S&P500, incorporates Orderflow, Market profile and Cycles to create Weekly Plans & Daily Plans to navigate the markets.

what they say

Subscriber Testimonials

I have a full-time job and soon to be father of two, so I don’t always have time every night to chart or if I’m busy working I can’t watch the markets during the day. The beautiful thing about this service is it fits perfectly, where I can keep up to date on what’s happening out there. And if I ever have downtime during the workday, the chat room provides a lot of other trade opportunities from the participants. This service offers much more than just alerts; the commentary and lessons from Josh and the other experienced traders is immensely helpful. No question is too dumb. I would absolutely recommend this to anyone.

- Shawn

Josh's trading record speaks for itself, but the real value in the Layup Trades service is the community. Every day on the Discord chat ideas are discussed, knowledge from some very experienced and smart traders is freely shared, and support and encouragement to both old and new traders is offered without prejudice. It is this camaraderie that has provided me invaluable support each trading day and is well worth the price of admission. I've learned more in a few years and developed a better mindset thru the service than in the prior decade plus in trying to trade on my own.

- Rob

I have been using the service for over a year. I can say with confidence that this room has the best of both worlds, trade ideas from JMVala and also a community that is happy to share the knowledge that they have. This community helps you become a better independent trader, something not many other trades services can say. I would happily recommend this service to anyone that was looking into trading.

- Barb

I have been tracking my "layup" trades as I do with any of the services, I use to evaluate them. MTD layup trades are just about to break five figures, or about 20% of my profits for the same period. Far and away better than any service I have used. I never tracked performance off your twitter feed (it was free, why bother?) Appreciate the room, you have collected a great bunch of followers, which is not surprising given your grace and helpfulness.

- - Rick

FAQs

Frequently Asked Questions

-

How does the two week trial work?

When signing up for the two-week trial, a credit card is requested upon sign up, but nothing is charged until the end of the 14th day, when your normal billing cycle will begin.

-

What exchanges and securities do you trade?

LayupTrades trades both the futures market (predominately the S&P and Nasdaq) as well as stock options (both directional and spreads)

-

Do you swing trade or day trade?

Most trades taken are held for some duration of time. Most long-term trades seek at least a 10% gain. While shorter-term day trades are taken, they are only alerted within the MoonRoom chatroom, while longer-term trades are alerted on Twitter as well as added to the account portfolio.

-

What methods of communication do you use?

The predominate communication tool for the service is our private Twitter handle. We also have a moonroom which is available for all members.

-

How many trades does the service take per month?

There is no set number of trades alerted. As the market ebbs and flows, so do the amount of alerts.